Last Updated on March 4, 2024 by Luke Feldbrugge

Welcome to the Housing Market Trends March 2024 monthly update from Homes for Heroes. This report focuses on the residential real estate housing market. We listen to the experts and boil down what they have to say to assist you, our heroes, with decision making regarding buying a home, selling your home, or refinancing your mortgage.

Housing Market Trends March Key Takeaways

The housing market is ever-evolving. Economic factors, government policies, interest rates, and even socio-cultural shifts can play a role in how the market behaves. That said, here are some housing market trends to help keep you informed as you determine what’s best for you.

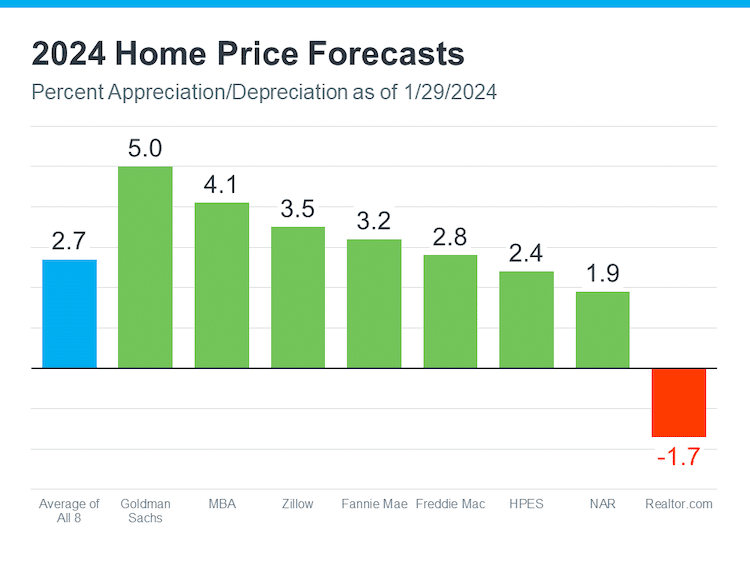

- Home Prices – Projected to appreciate by 2.7% in 2024, continuing the trend from 2023.

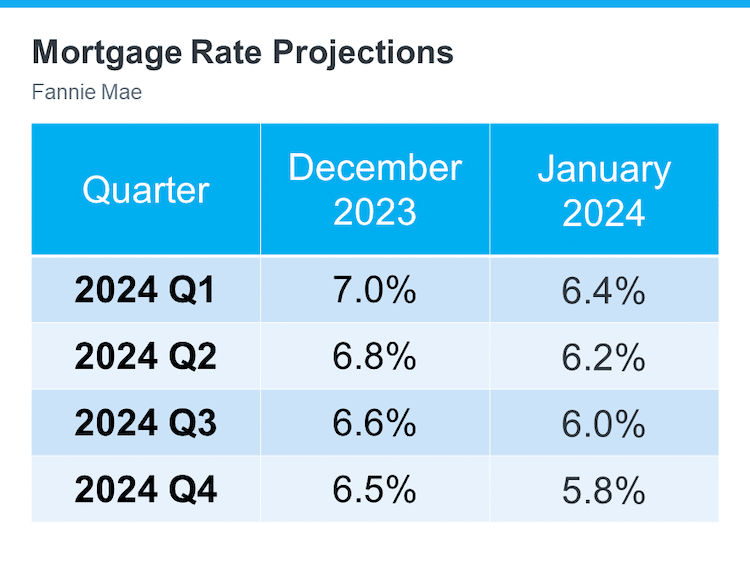

- Mortgage Interest Rates – Currently rising, but projected to decline to below 6% by year-end.

- Inventory Increase – 2% increase in existing home inventory month over month in January, shows a positive sign for homebuyers.

Home Prices Will Continue to Appreciate in 2024

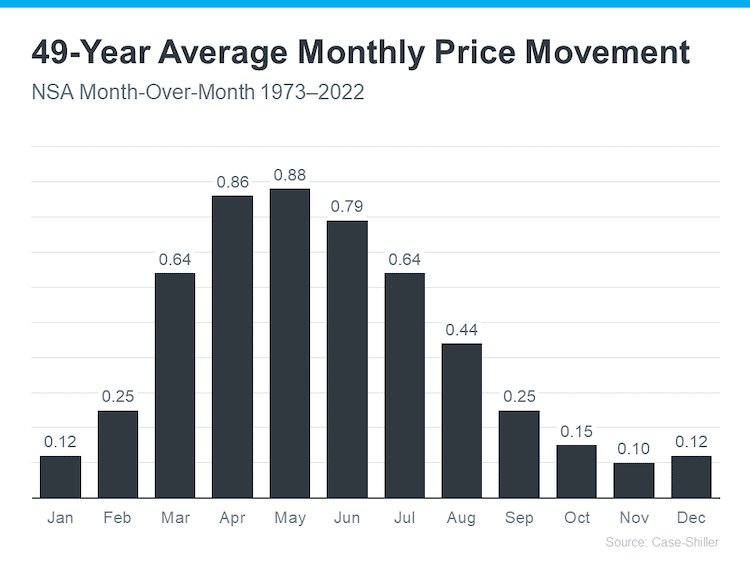

Here is the average monthly price movement for the calendar year over the past 49 years. If you’re a home buyer, you can see how the beginning of the year and the tail end of the year, average less appreciation so you can get more home for a lower price.

As demand grows, moving into the busy home selling season of March – August, the average home price typically appreciates in sync with buyer demand. However, due to the low average in some months, there is a chance that home prices may decline some months. That is normal market behavior.

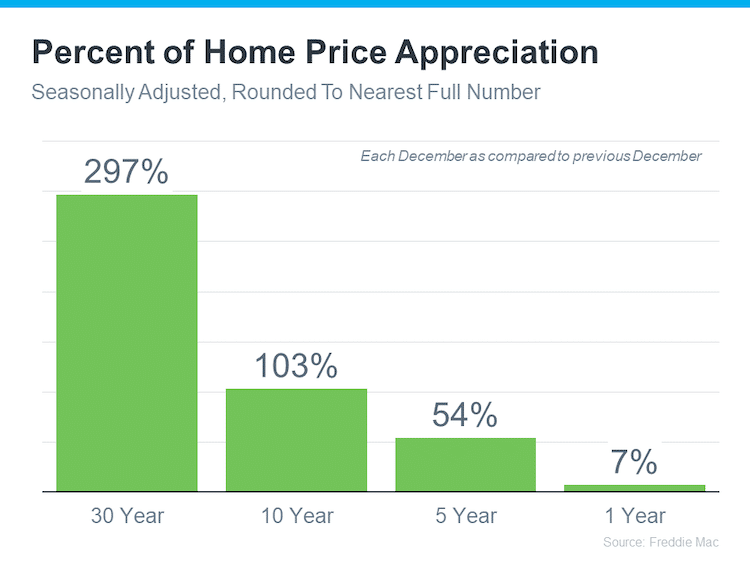

According to FHFA’s Home Price Index, for 12 months from November 2022 – November 2023, home prices increased 6.6% in the U.S. Great news for home sellers, but not so great news for home buyers who may be struggling to find affordable housing options.

If you’re looking to become a homeowner, don’t give up the hunt because prices are increasing. Generally speaking, you want house prices to gradually increase. Because as the graph above illustrates, homeownership is a great long-term investment opportunity. It’s an asset that can increase your overall net worth substantially over the course of 30 years.

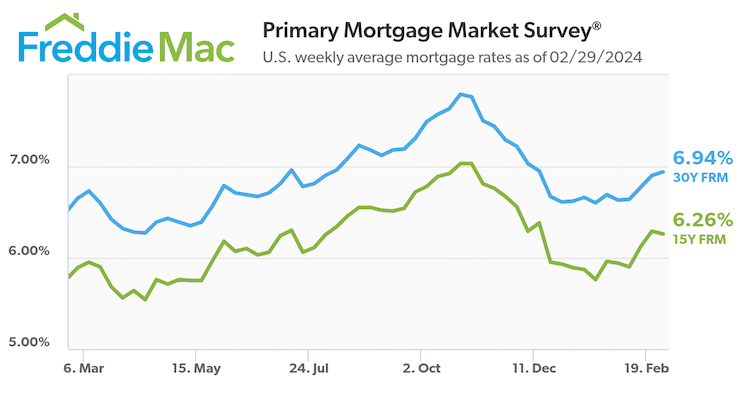

Home Mortgage Interest Rates Recently on the Rise

As of writing this update, Freddie Mac’s Primary Mortgage Market Survey is reporting a 30 year fixed rate mortgage at 6.94%. That’s up from the 6.69% reported for the end of January, leading to the fourth consecutive week of a rate increase. The last four weeks of mortgage interest rates ticking up may be keeping some home buyers on the sidelines as we enter the beginning of the busy season in March.

https://www.freddiemac.com/pmms

It looks like Freddie Mac believes mortgage interest rates will drop below 6% by the end of 2024, per their revised estimate of 5.8% in Q4, down from their previous 6.5% projection in December 2023.

This is great news for both buyers and sellers. Great for buyers who are struggling with home affordability. Same for home sellers who are waiting to put their home on the market until they’re in a better position to purchase a new home as well.

Inventory of Existing Homes Increased in January

According to the NAR Existing Home Sales report posted February 22, the inventory of homes increased 2% from December 2023, and it’s up 3.1% from January 2023. Yes, it’s in the winter months, and the comparison time frame is after the holidays, but this is still great news! Additional inventory will help home buyers find a home, and hopefully this upward trend continues to alleviate some of the competitive pressure home buyers are currently facing.

Receive an Average of $3,000 from Homes for Heroes

Homes for Heroes assists firefighters, EMS, law enforcement, active military and veterans, healthcare workers and teachers; with buying, selling and refinancing their home or mortgage. But if you work with our local real estate and mortgage specialists to buy, sell or refinance; they also provide significant savings after you close on a home or mortgage. We refer to these savings as Hero Rewards, and the average amount received after closing on a home is $3,000, or $6,000 if you buy and sell!

Simply sign up to speak with a member of the team. There’s no obligation. After you sign up a member of our team will contact you to ask a few questions and help you determine the appropriate next steps for you.

When you’re ready, we will connect you with our local real estate and/or mortgage specialists in your area to assist you through every step and save you money when it’s all done.

It is how Homes for Heroes and our local specialists thank community heroes, like you, for your dedicated and valuable service.

LIST OF SOURCES:

https://www.spglobal.com/spdji/en/indices/indicators/sp-corelogic-case-shiller-us-national-home-price-nsa-index/#overview

https://www.freddiemac.com/research/indices/house-price-index

https://www.zillow.com/research/2024-housing-predictions-33447/

https://www.realtor.com/research/2024-national-housing-forecast/

https://cdn.nar.realtor//sites/default/files/documents/forecast-q1-2024-us-economic-outlook-01-26-2024.pdf

https://www.goldmansachs.com/intelligence/pages/us-home-prices-forecast-to-climb-as-mortgage-rates-fall-in-2024.html

https://www.mba.org/news-and-research/forecasts-and-commentary/mortgage-finance-forecast-archives

https://www.fanniemae.com/media/50096/display

https://www.freddiemac.com/research/forecast/20240122-us-economy-continues-expand

https://www.fanniemae.com/media/49866/display

https://www.fanniemae.com/media/50096/display

Hi, I checked military Air Force since I didn’t see an option for Veterans. Is this an appropriate site to use a VA loan. Thank you Janet email address is: he59jw@gmail.com

Hi Janet, a member of our team will email you.

Is a pca considered a health care professional? And do you leave messages I don’t answer numbers I don’t know?

Hi Kellie, all healthcare professionals qualify for the savings we provide. Simply sign up using our online form and a member of our team will contact you so you can get your questions answered and we can determine the best way to serve your needs. We look forward to speaking with you, Kellie!