Welcome to the Housing Market Trends May 2025 monthly update from Homes for Heroes. This report focuses on the residential real estate housing market. We listen to the experts and boil down what they have to say to assist you, our heroes, with useful information to help you understand current housing market conditions and how they apply to your goal of buying a home, selling your home, or refinancing your mortgage. This snapshot will help you make informed decisions based on your current needs.

Housing Market Trends May Key Takeaways

The housing market is ever-evolving. Economic factors, government policies, interest rates, and even socio-cultural shifts can play a role in how the market behaves. That said, here are some housing market trends to help keep you informed as you determine what’s best for you.

- Mortgage rates are holding steady around 6.70%, with potential rate cuts later in the year that may lower future rates.

- Housing inventory is up nearly 20% year-over-year, giving buyers more options, especially in the South and West regions of the U.S.

- Home prices hit a new record ($403,700), good for sellers but still challenging for buyers.

- Spring is the best time to list for sellers, with buyer activity peaking in April and May.

- Buyers may gain more negotiation power as homes stay on the market longer and inventory grows.

- Save with Homes for Heroes – The Homes for Heroes program provides significant savings to community heroes (firefighters, EMS, law enforcement, active-duty military and veterans, healthcare professionals, and teachers) with an average savings of $3,000 after buying, selling, or refinancing a home with their local specialists. Sign up today to begin and a Homes for Heroes local specialist will contact you to answer your questions.

Current Mortgage Rate Trends

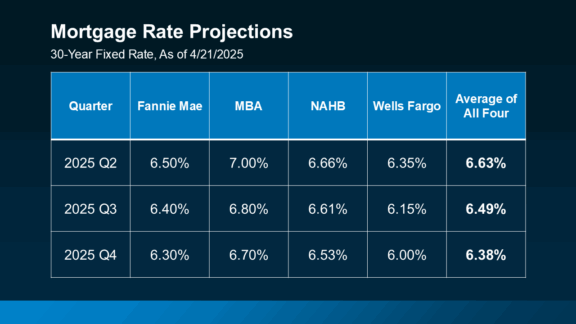

Quarterly mortgage rate projections for the remainder of the year, from four leading lending organizations in the industry, show an average 30-year fixed mortgage rate of 6.63% for quarter two, 2025. The average for year-end is projected be 6.38%

Latest Averages – As of April 29, 2025, the average 30-year fixed mortgage rate stands at approximately 6.70%, according to Optimal Blue Mortgage Market Indices, showing a slight decrease from 6.82% earlier this month.

Recent Stability – Over the past three months, mortgage rates have fluctuated within a relatively narrow range of 6.59% to 6.88%, indicating a period of comparative stability in the lending market.

Current Outlook – For a hero purchasing a $350,000 home, using a 30-year fixed rate FHA loan, with a minimum 3.5% down payment, with today’s average mortgage rate of 6.70% translates to an estimated $2,200 monthly mortgage payment (this includes property taxes, home insurance, and mortgage insurance). If you would like to better understand your situation, visit the Homes for Heroes mortgage calculator to find out your estimated monthly mortgage payment.

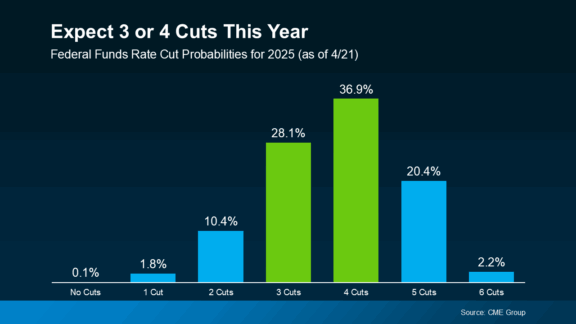

Future Outlook – Economic factors, including recent tariff implementations and Federal Reserve policies, may cause inflation issues, potentially influencing future mortgage rates. Not necessarily in a negative fashion. For example, the CME Group shows many are anticipating 3-4 rate cuts from the Federal Reserve in 2025. The Fed does not directly determine mortgage interest rates, but movement in the federal rates may potentially impact mortgage rates.

Home Inventory Trends

Increase in Listings – The total housing inventory at the end of March was 1.33 million units. That’s up 8.1% from February 2025, and up 19.8% from March 2024, according to NAR’s monthly newsroom report.

Newly Built Homes – According to Census and NAR data, newly built homes are 31.4% of all homes for sale as of February 2025. Giving would-be buyers a larger selection of home options.

Regional Variations – According to Realtor.com, the South (+31.1%) and West (+40.3%) are experiencing the largest inventory growth year-over-year, whereas the Midwest (+17.7%) and the Northeast (+11.3%) have also increased inventory respectively, but not to the same levels. This creates potentially favorable conditions for local hero home buyers which may give home buyers more home price negotiation leverage.

Home Pricing Analysis

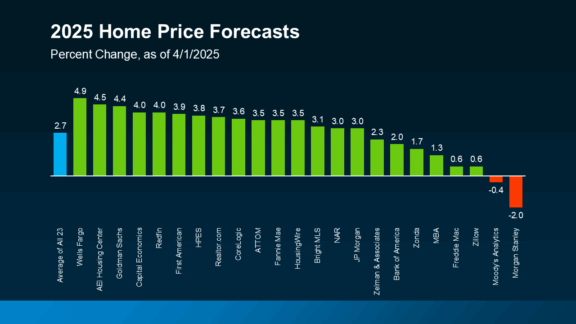

National Median Price – The median existing-home sales price reached $403,700 in March 2025, marking a 2.7% increase from the previous year and setting a new record for the month, according to NAR’s latest report. This price appreciation is great news for sellers as you continue to increase your home equity, but it makes home affordability more challenging for home buyers.

Price Forecast – According to 23 industry leading organizations, the average home price forecast percent change for 2025 is a 2.7% increase. 21 out of 23 industry leaders forecast price appreciation in 2025, primarily due to increased inventory, potentially creating improved market entry opportunities for first-time hero homebuyers.

Timing Considerations

Military PCS Orders – With summer relocation season approaching, home inventory is expected to increase in the spring and summer months, according to seasonal trends identified by Realtor.com, potentially creating better selection for military families receiving PCS orders.

School Year Transitions – For educators, aligning home purchases with the academic calendar is strategically important. Increases in inventory levels over the spring and summer months make the spring season the best time to start your home search.

Shift Work Considerations – For healthcare workers and first responders with non-traditional schedules, the current market’s longer days-on-market offers you more flexibility for viewing homes around shift work. According to NAR, and their monthly REALTORS® Confidence Index, properties typically remained on the market for 36 days in March. It was 33 days in March last year.

Homebuyer Outlook and Recommendations

Despite increasing inventory, high mortgage rates and home prices continue to present affordability challenges. However, the rise in active listings in many U.S. markets may provide buyers with more leverage in negotiations.

Strategic Considerations for Buyers:

Budget Assessment – Evaluate your finances. Consider current mortgage rates and get an idea of how much house you can afford, then use our mortgage calculator to estimate the mortgage terms you need to make it work.

Profession-Specific Program Research – Investigate all programs available to your profession. For example, we have a great post on down payment assistance programs for each state, and our specialists are aware of any state or local market opportunities available to assist with the cost of buying or selling a home. Simply sign up today to discuss your plans with our local specialist in your area.

Long-Term Planning – Given market volatility, plan for a longer-term stay in a home you purchase (5+ years if possible) to build equity. NAR data shows that homeowners who stay 5+ years have historically avoided negative equity, even during market corrections.

Home Seller Outlook and Recommendations

The spring season traditionally sees increased buyer activity, which it has this year. However, it has been more moderate this spring versus previous years. This may indicate a slight shift away from the strong sellers market over the past few years, as homes stay on the market longer, and buyers begin to negotiate terms more often.

Strategic Considerations for Sellers:

Market Timing – List earlier rather than later this spring, April-May typically has more buyer activity than summer months in most markets.

Pricing Strategy – With median home prices at record highs but more inventory available, competitive pricing is extremely important to avoid extended time on the market.

Home Presentation – How your home looks and feels to a potential buyer is extremely important to receiving offers. Here are some tips for putting your house on the market.

Hero Appeal – If your home is located near hospitals, schools, fire stations, or military bases, highlight these proximity advantages for your home, as they can attract specific buyer demographics and potentially reduce days on market.

Success Stories from Fellow Heroes

Here are testimonials from two heroes who closed on their home recently. They successfully navigated market challenges, and saved significant money by working with our local real estate and mortgage specialists to get it done:

“My agent went above and beyond. He not only has integrity and patience, he is very knowledgeable. Being a veteran myself, I respect and appreciate his dedication and commitment, and his service to this beautiful country. We will always be grateful for the time he took to get to know us. It has to be tough in this market to be a REALTOR, yet he still showed up. He was very professional and always had a positive, looking forward attitude. Clients for life.” – Spirit, in the state of Washington

“Our agent was the best real estate agent I’ve ever had. She was fun, professional, easy to communicate with, and very good at listening to what I wanted! She delivered what she promised! Thank you Homes for Heroes for acknowledging us heroes in this way! Every penny saved is so appreciated!” – McCoy, in the state of Texas

Receive an Average of $3,000 from Homes for Heroes

Homes for Heroes assists firefighters, EMS, law enforcement, active military and veterans, healthcare professionals and teachers; with buying, selling and refinancing their home or mortgage. But if you work with our local real estate and mortgage specialists to buy, sell or refinance; they also provide significant savings after you close on a home or mortgage.

We refer to these savings as Hero Rewards, and the average amount received by a hero who closes on a home with our local specialists is $3,000, or $6,000 if you buy and sell!

Simply sign up to speak with a local Homes for Heroes specialist in your area. There’s no obligation. After you sign up, a member of our team will contact you to ask a few questions and help you determine the appropriate next steps for you.

Our local real estate and/or mortgage specialists in your area are ready and willing to assist you through every step of the process, and save you money when it’s all done.

It is how Homes for Heroes and our local specialists thank community heroes like you for your dedication and valuable service.

Estimate Your Savings

Learn how much you could save on your home purchase. Adjust the slider to see potential savings when you buy with a Homes for Heroes real estate and mortgage specialist. This is an estimate. Your actual savings may vary.