Home loans for nurses offer special opportunities that recognize the unique challenges healthcare professionals face. Whether you’re a new graduate managing student debt or an experienced RN looking to upgrade your living situation, understanding your mortgage options can help you secure the best home financing with confidence.

Key Takeaways

- Nurses have complex income patterns, so it’s important to work with lenders who understand healthcare pay.

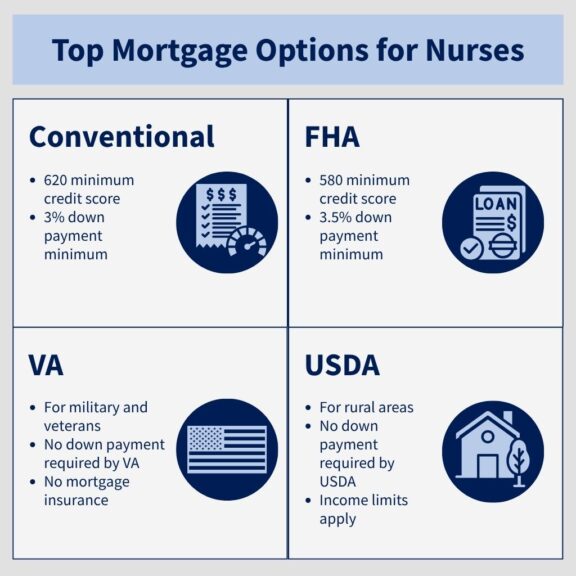

- Multiple home loans for nurses exist, including FHA, VA, USDA, and conventional loans.

- Student loans don’t have to block approval due to special forgiveness and income-based repayment programs.

- New and travel nurses can qualify for a mortgage if they have a job offer, contract, and/or proper documentation.

- When nurses purchase a home with Homes for Heroes using their local specialists, the average savings is $3,000. $6,000 if you sell a home too. This savings amount is in addition to any other down payment assistance programs you may qualify to receive.

Home Financing Challenges for Nurses

Nurses face distinct financial challenges that traditional mortgage underwriting doesn’t always accommodate very well. How you earn your wages from nursing can be very complex given your specific role as a nurse and the duties you are expected to fulfill.

Shift Work Income Documentation Challenges

Unlike traditional 9-to-5 workers, nurses often earn income through multiple sources that can complicate mortgage applications:

- Base hourly wages that vary with scheduled shifts

- Shift differentials for nights, weekends, and holidays

- Overtime compensation that fluctuates based on staffing needs

- On-call pay and per diem rates for extra shifts

- Travel nursing premiums and housing stipends

Lenders typically want to see two years of consistent income, but nurse income can vary significantly month to month. The key is working with loan officers who understand healthcare compensation structures and can properly document these income streams.

Homes for Heroes mortgage specialists are experienced in working with nurses to help them determine the most appropriate home financing option. Sign up today to learn more about how your local Homes for Heroes mortgage specialist can assist you, and also save you significant money if you close with Homes for Heroes.

Student Loan Impact on Mortgage Qualification

Most nurses graduate with student debt, which affects their debt-to-income (DTI) ratios. The average nursing student graduates with $40,000-$60,000 in student loans.

However, several factors work in nurses’ favor:

- Income-driven repayment plans can lower monthly obligations

- Public Service Loan Forgiveness may eliminate debt for qualifying nurses

- Employer loan repayment programs offered by many healthcare systems

- Specialized lender policies that account for student loan forgiveness timing

Top Home Loans for Nurses – Comprehensive Breakdown

Understanding mortgage options and the best home financing for nurses makes it easier to choose the right option for your circumstances. These types of mortgages for nurses offer different benefits designed to address common challenges you may face.

Credit Score and Financial Standard Requirements

Important: The following information provided for these specific loan types is general information, and does not account for your personal financial circumstances, or how a specific lender may assess your personal financial status.

| Loan Type | Minimum Credit Score | Typical Down Payment | Debt-to-Income Ratio |

| Conventional | 620+ | 3-20% | Up to 36% (standard max) |

| FHA | 580+ (500 with 10% down) | 3.5% Minimum | Up to 43% (standard max) |

| VA | No Minimum (lender dependent) | 0% (Not required by VA) | Up to 41% (standard max) |

| USDA | 640+ preferred | 0% (Not required by USDA) | Up to 41% (standard max) |

Conventional Home Loans for Nurses

Conventional mortgages (Conforming Loan) remain the most popular choice for nurses with stable credit and employment history.

Key Features:

- Minimum credit score – 620 (scores of 740+ get best rates)

- Down payment – Most will put down 20 percent to avoid paying Private Mortgage Insurance (PMI). But a borrower may put down as low as 3 percent for first-time buyers if the lender allows. The lower the down payment, often means the higher the interest rate. At this point, an FHA loan might be a better option for you.

- Private Mortgage Insurance (PMI) – Required to pay if your down payment is under 20 percent.

- DTI Ratio – Most lenders will require a debt-to-income ratio (DTI) less than 36 percent. However, in some cases, lenders will allow a borrower to have a DTI up to 43 percent.

- Conforming loan limit – On a single unit home the loan limit is $806,500 per Fannie Mae in most U.S. counties ($1,209,750 in High-Cost Areas). If you want to see the median income and conforming loan limits in the neighborhood you’re interested in, visit the Fannie Mae Area Median Income Lookup Tool.

Fixed and Adjustable Rate Mortgages:

Conventional home loans for nurses typically come with 30-year or 15-year duration terms. This means by making the required payments each month, you will finish paying off your loan in that amount of years. When it comes to the interest rate options on these loans, there are two main types:

- Adjustable-rate mortgages (ARMs) start with a lower fixed interest rate for 3–10 years, making them appealing for short-term homeowners, but rates can rise later, adding risk.

- Fixed-rate mortgages keep the same interest rate for the entire loan term, offering predictable payments and long-term stability for most homebuyers.

Best for: Nurses with good credit scores, stable employment, and ability to handle PMI payments if unable to make a 20 percent down payment.

Nonconforming conventional loan: This is another type of conventional loan where lenders may set their own limits, which includes jumbo loans.

FHA Loans for Nurses

FHA loans for nurses provide accessible financing with lower credit scores or limited savings available for a down payment.

Key Features:

- Minimum credit score – 580 for 3.5 percent down payment (can be as low as 500 with a 10 percent down payment, but only if a lender is willing to take on the risk)

- Down payment – As low as 3.5 percent (but you will be required to pay a Mortgage Insurance Premium, MIP)

- Mortgage Insurance Premium (MIP) – These payments secure the loan and are required for the duration of the loan

- FHA loan limit – The CY2025 basic standard mortgage limit for an FHA Forward insured loan for a single family home is $524,225. But, if you want to better understand the FHA loan limit for your specific area of the country, check out the Federal Housing and Urban Development Department’s FHA Mortgage Limits page.

Gift Funds

Gift funds can be used for the down payment, closing costs or cash reserves. Be sure to understand who is an acceptable gift fund donor. In most scenarios, you can receive usable gift funds from a:

- Family member

- Employer or labor union that offer homeownership assistance programs

- Charitable organization that offers assistance to families or first-time homebuyers

- Government agency or public entity who offers homeownership assistance programs

Employment Letters for New Nursing Graduates – Yes, FHA loans generally accept employment letters for new nursing graduates, even if you have not received your first paycheck. However, you must have a job offer in the nursing field.

FHA loans are best for new graduate nurses, those rebuilding credit, or nurses with limited savings for down payment.

VA Loans for Military Nurses and Veterans Who Became Nurses

Military nurses and veterans who are now nurses (or were nurses) have access to one of the best mortgage programs available, the VA Home Loan.

Key Features:

- No down payment required (private lenders may require downpayments for some borrowers using the VA home loan guaranty, but VA does not require a downpayment)

- No private mortgage insurance (PMI)

- Competitive interest rates (can be 0.25%-0.5% below conventional)

- Reusable benefit for multiple home purchases

- Assumption options for qualified buyers

Eligibility Requirements:

- Active Duty, Veteran, or qualifying surviving spouse

- Certificate of Eligibility (COE) from VA

- Primary residence occupancy requirement

- Meeting credit and income standards (varies by lender)

VA Loan Funding Fee

There will be a VA funding fee required for your VA home loan. Your lender may provide financing options for this fee so you do not need to pay it out of pocket at closing.

USDA Loans for Nurses

USDA loans for nurses are a great option for home financing if you want to live in a rural community or on rural land.

Key Features:

- No down payment required

- Typically offer below-market interest rates

- Income limits by state

- Property location – Must be in USDA-eligible rural area

- Upfront guarantee fee may not exceed 3.5 percent of the principal obligation, and the annual guarantee fee applies for the life of the loan. Here is a guide on these fees from USDA.gov.

Great for: Nurses relocating to rural healthcare facilities or those already working in qualifying areas.

Special Home Financing Opportunities for Nurses

Homes for Heroes is the longest running, most experienced home buying program for nurses, and we provide the most nurse savings after you work with our local real estate and mortgage specialists and close on your home or mortgage.

Other nurse home buying programs that offer grants for nurses claim to provide higher savings amounts. Unfortunately, those organizations are advertising “up to” amounts as the norm for all nurses, and those amounts are rarely received due to the eligibility requirements.

Homes for Heroes

Homes for Heroes and our local real estate and mortgage specialists provide significant and exclusive savings for nurses when you buy and sell a home through the Hero Rewards program. It is our way to say, thank you for your service.

Program Benefits:

- Average savings – $3,000 per transaction, $6,000 if you buy and sell a home. Nobody offers a higher average savings amount to nurses without requiring special qualifications.

- Shortly after you close, you receive a Hero Rewards check you can spend on new furniture, appliances, renovations, maintenance expenses, or any other expense you want to use it on! It comes in very handy after moving into a new home.

- No additional fees, costs to participate, or red tape deal with.

- Work with a local Hero-experienced real estate agent and lender in all 50 states.

Simple Eligibility Requirement – Active, previously employed, or retired nurses; including RN, NP, CNS, APRN, LPN, LVN, CNA, School Nurse, Public Health Nurse, and Clinical Nurse Educators.

Offer the Most Savings – For over 20 years, Homes for Heroes remains the original hero home savings program who offers nurses the most guaranteed exclusive savings when you work with our local real estate and mortgage specialists, and other local partners to buy a home, sell a home, or refinance a mortgage.

Additional Down Payment Assistance – Local Homes for Heroes mortgage specialists leverage federal, state, and local down payment assistance for nurses, and first time home buyer programs when possible to maximize the dollars you save. And, the savings Homes for Heroes provides is in addition to any assistance you may qualify to receive through other government or private down payment assistance programs for nurses or first time home buyers.

“This is an amazing program that was very helpful for me in buying a home. It is very easy to feel underpaid and underappreciated as a nurse, especially where I live, so this was such a great program to find. My realtors were incredible and I am so glad they participate in this program!” – Emily in Colorado

Special Tools and Insights:

- Estimate the savings you would receive if you purchased a home with Homes for Heroes and our local specialists.

- Estimate your monthly mortgage payment to better understand how much home you can afford to purchase and successfully make your monthly payments.

- Find out current mortgage rate estimates for select loan types.

Sign up today to speak with your local Homes for Heroes mortgage and/or real estate professionals to find out more about how Homes for Heroes can serve your needs and save you money in the process.

Frequently Asked Questions About Home Loans for Nurses

Q1: Do nurses get special discounts on mortgage loans?

Yes, nurses can access several specialized programs offering significant savings. Programs like Homes for Heroes offer an average savings of $3,000 per transaction.

Q2: Are there home loans for nurses with bad credit?

Absolutely. Nurses can qualify for FHA loans with credit scores as low as 580, and some lenders may accept scores as low as 500 with a higher down payment, depending on their policies and the borrower’s financial circumstances.

Q3: How do lenders verify income for travel nurses?

Travel nurses can qualify by providing:

- Tax returns from the past 2 years showing consistent income. Most lenders require at least 2 years of travel nursing history for income stability.

- Current contracts demonstrating ongoing assignments

- Letters from staffing agencies confirming continued work

- Bank statements showing regular deposits

Q4: What if I’m a newly licensed nurse with limited work history?

New graduate nurses can qualify through:

- Employment offer letters with start dates and salary information

- Nursing school transcripts and graduation verification

- Some lenders count clinical rotations toward work experience

- FHA and specialized nurse programs are most accommodating for new graduates

Q5: Can nurse mortgage loans be used for investment properties?

Most nurse-specific programs and grants are restricted to primary residences only. However, nurses can use conventional, FHA, or VA loans for investment properties following standard program guidelines.

Q6: How is overtime and shift differential income calculated?

Lenders typically average overtime and shift differential income over the past 2 years, then use 75% of that average for qualification purposes. This conservative approach accounts for the inconsistency of this income while still recognizing its contribution to your overall earnings.

Q7: Do I need to work with specific lenders for nurse home programs?

Special nurse home loans typically require working with approved lenders:

- Homes for Heroes requires using a Homes for Heroes loan officer

- State programs often have approved lender lists

- VA and USDA loans can be obtained through any approved lender

Q8: Can I combine multiple nurse assistance programs?

In many cases, yes. For example:

- Homes for Heroes savings can be applied to any loan type, and more importantly, the savings is in addition to state and federal programs you may also qualify to use.

- State programs may be stackable with federal programs

- Always verify with program administrators before proceeding

Q9: How do student loans affect mortgage qualification?

Student loans impact your debt-to-income ratio, but lenders consider:

- Income-driven repayment plan amounts (not full balance)

- Potential loan forgiveness programs

- Deferment status and payment history

Q10: What documentation do I need for nurse shift work income?

Typical essential documents include:

- Most recent 60 days of pay stubs showing year-to-date earnings

- Past 2 years of tax returns with all schedules

- Employment verification letter from HR

- Bank statements showing regular deposit patterns

- Explanation letter for any income variations

Conclusion

Navigating the home loan process as a nurse comes with unique challenges, but you also have access to powerful resources and programs designed to help you succeed. Whether you’re just starting your career or have years of experience, understanding your options can make homeownership more affordable and achievable.

Things to Remember:

- Nurse income can be complex, so choose a lender familiar with healthcare pay structures.

- Loan programs like FHA, VA, USDA, and conventional loans offer flexible options for nurses.

- Student loan debt doesn’t have to prevent you from qualifying for a mortgage.

- Homes for Heroes provides the most guaranteed savings for nurses. An average of $3,000 when you buy a home using their local agent and lender.

- New grads and travel nurses can still qualify with the right documentation and support.

Next Steps for Nurses:

- Review your current income and credit score to understand your starting point.

- Explore loan options that best fit your work history and financial goals.

- Gather your documentation, including pay stubs, offer letters, and/or tax returns.

- Sign up to speak with a local Homes for Heroes mortgage specialist to get expert help and maximize your savings. They understand nursing careers and can guide you through your next steps.

Your dedication to caring for others has earned you access to these valuable home loan and home buying benefits. Now it’s time to use them, and Homes for Heroes would be honored to assist you.

Estimate Your Savings

Learn how much you could save on your home purchase. Adjust the slider to see potential savings when you buy with a Homes for Heroes real estate and mortgage specialist. This is an estimate. Your actual savings may vary.