When it comes to buying a house, it helps to understand exactly what you can afford – and that starts by understanding the costs of buying a house. Your mortgage payment will be the biggest recurring payment on your home. But there are four other primary costs of buying a house that you need to know about. Here’s a breakdown of the four other costs and how working with Homes for Heroes to buy a home can help with costs.

COST #1: House Down Payment Cost

First things first, what is a down payment on a home? A down payment is a portion of the total home sale price paid to the seller. The remaining portion is the money you borrow with a mortgage loan. For example, if the home price is $200,000 and you decide to pay a 10% down payment, your down payment will be $20,000 and the remaining $180,000 will be covered by your mortgage loan. Your down payment and mortgage loan terms will vary depending on your credit history, loan type, income, and other factors.

Why do home buyers need to pay a down payment?

It helps offset the risk lenders take by loaning you the money for your mortgage. The less you borrow, the less risk to the lender in losing money if payments cannot be made. This is also why home buyers who pay less than a 20% down payment usually need to pay private mortgage insurance (PMI) with a conventional loan or mortgage insurance premiums (MIP) with an FHA loan.

Where can I get the money for a down payment?

The money for a down payment can come from your own savings, the money you get when you sell a house, or gifts and grants from family, employers and nonprofits.

When will I need to pay my down payment?

When you’re sitting at the closing table. Typically it will be paid with a cashier’s check from a bank.

Do I need to put 20% down?

You’ve probably heard before that you shouldn’t buy a house unless you can pay 20% down payment. If you can afford to, there are benefits to putting 20% down, like:

- Only 80% needs to be borrowed in a loan. If you ask for less money, the bank might be more willing to borrow to you

- You can receive a lower interest rate on your loan, reducing the amount you’ll pay over the lifetime of the loan

- You will not need to pay private mortgage insurance (PMI), reducing your overall payments

However, if putting 20% down cleans out your savings and leaves you without financial reserves, it may not be the best option for you. But don’t worry, there are still options if you do not put down 20%!

Lower Down Payment Options

FHA loans are an option for a mortgage with a lower down payment. FHA home loans allow buyers to pay as little as 3.5% of the home purchase price as a down payment. This type of loan is also a good option for home buyers with lower credit scores. Home buyers can technically qualify for an FHA loan with a credit score of 580 or higher, according to HUD.

This is a great option for home buyers who do not have significant amounts of cash for a down payment. These loans carry private mortgage insurance, but it goes by a different name: mortgage insurance premiums (MIP). MIP includes two premiums. You have an upfront premium that can be rolled into your mortgage or paid at closing, and a monthly premium that is included as part of your mortgage payment.

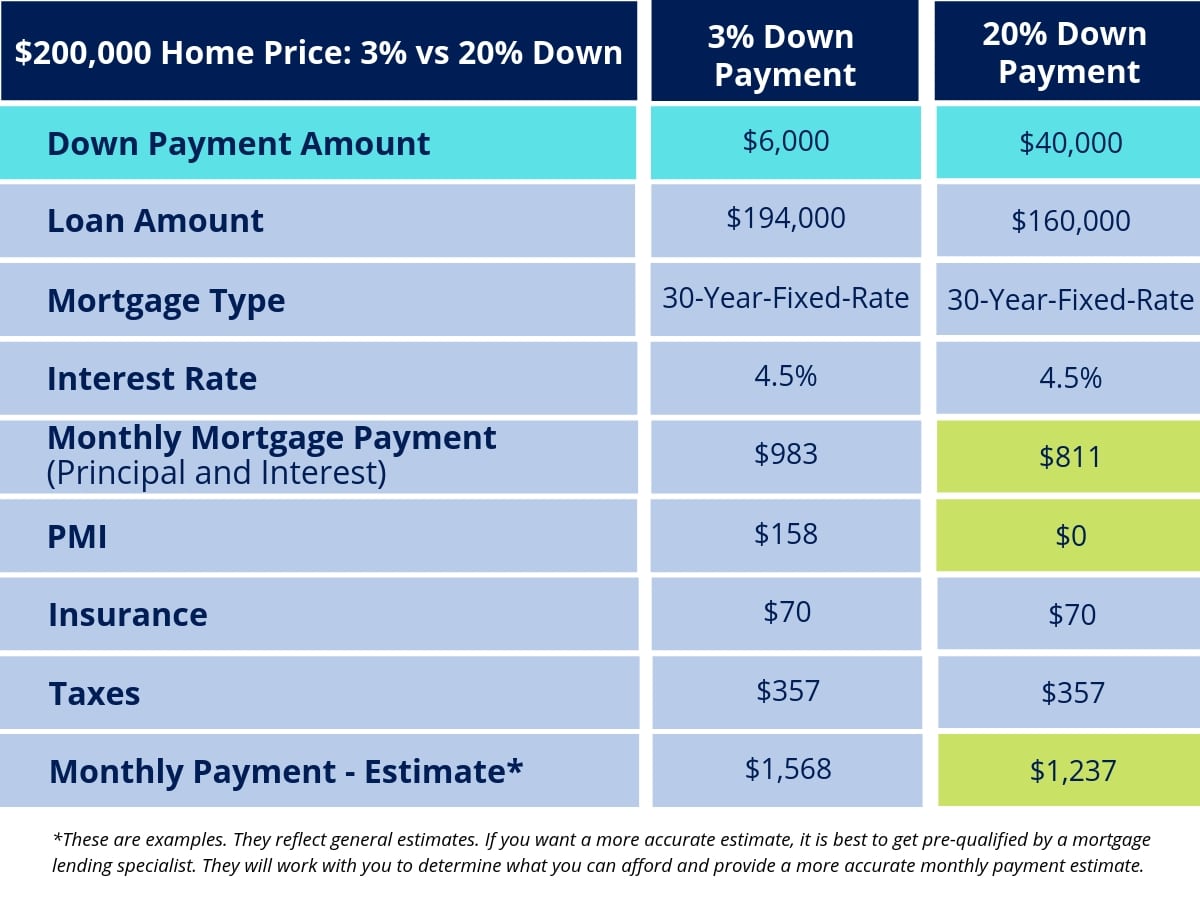

Down Payment Impact on Monthly Payments

Here are two examples for a $200,000 priced home with a 3% down payment versus a 20% down payment. Notice the different down payment amounts in light blue, and the 20 percent down payment money savings shown in green.

What About NO Down Payment Options?

There are options where the home buyer is not required to pay a down payment. However, there are set criteria for qualified home buyers. These are the two most popular options:

VA Home Loans for Qualifying Military Members

The Department of Veterans Affairs guarantees VA loan mortgages with no required down payment for qualified veterans, active duty service members and members of the National Guard and Reserves. There is no mortgage insurance cost, and often the interest rates are lower.

USDA Home Loans for Eligible Buyers

The USDA home loan, meant as a way to develop rural areas, is a no money down option that is not limited to farm land. However, you must meet their eligibility requirements. For example, there are geographical limits, household income restrictions, and it is primarily intended for first-time home buyers.

If you qualify for either of these types of no down payment loans, you should know you can use these loans in conjunction with Homes for Heroes’ Hero Rewards, and save more money by working with our local specialists.

COST #2: Earnest Money Deposit

What is earnest money?

The purpose of earnest money is to serve as a good faith deposit to the seller. It helps to show the seller you’re committed to buying the home and honoring the real estate purchase contract. If you enter a contract with a seller, the earnest money also serves as funds that the seller keeps if you breach the contract, like backing out of the sale before closing. If the sale does go through, the earnest money will go towards your down payment.

When is earnest money due?

Generally, earnest money is due after your offer is accepted by the seller, and you have both signed the purchase agreement. At this time, you will give your earnest money deposit to the title company (or real estate broker in some states) who will hold the funds in an escrow account until the home sale is in the final stages. Never give the money directly to the seller. If everything goes as outlined in the purchase agreement, the earnest money is released from escrow and applied to your down payment and closing costs.

How much is generally accepted as an earnest money deposit?

Your local market probably has a standard acceptable amount for an earnest money deposit, however, generally speaking, it’s between 1-5% of the home purchase price. It can be as high as you’d like it to be. Generally speaking, to give you the best opportunity of landing the house you want, it’s wise to have 5% of the purchase price available in your checking account before you begin making offers on homes.

However, do not let this discourage you. Sellers often accept lower earnest deposit amounts. At a minimum, you should have 1% set aside. Your real estate agent will be the best source for an acceptable amount.

Can I get my earnest money deposit back?

That all depends on how the earnest money was written into your purchase agreement. Usually, there is a point in the buying process where you will no longer be able to get your earnest money back if the deal falls through. This is typically after both sides agree on an inspection, but again, it is completely dependent on the purchase agreement. Typically, if you find that there is significant damage during your inspection, you are allowed to walk away from the deal and typically get your earnest money back.

If anything happens between that time and the time that both parties sign the paperwork at closing, for example, you change or your mind or find a house you like even better, you will most likely forfeit your earnest money. Make sure to discuss your earnest money options with your real estate agent.

COST #3: Planning for Closing Costs

What does “closing” mean?

Closing is the point in time when the Title (official document of ownership) of the property you’re purchasing is transferred from the seller to you. This is when the home officially becomes yours, legally.

What are closing costs?

Closing costs are fees associated with the purchase of your home, paid at the closing of your real estate transaction. Closing costs are generally 2-5% of the total purchase price of the house. So if your new home costs $200,000 your closing costs would likely land between $4,000 – $10,000. The fees that make up your closing costs vary widely due to where you live, the home you buy, and the type of loan you choose. Here is a list of home closing costs that you may need to pay for your real estate transaction.

There are times when the seller will agree to pay some or all of the closing costs, but that is on a case by case basis you can discuss with your agent and lender. These are usually also presented in the purchase agreement so that both parties are aware of what costs will be associated with this deal.

Your team of real estate and lending professionals should keep you informed of everything you are responsible to pay at closing, and provide you with a checklist of everything you will need to bring to your closing. To pay your closing costs, you will likely need a cashiers check from a bank.

COST #4: Moving Costs

Another cost of buying a house is all the moving costs. You’re uprooting your life along with all your belongings. Whether you are moving thousands of miles away or two blocks down the road, it still takes time, money and planning. The kicker about moving costs is they often end up being more than you anticipated (or hoped). Bottom line, the cost of buying a home and moving is expensive.

Moving Company

If you need to hire a moving company, do not cut corners to save a buck. After all, you want them to take care of your belongings. If an accident happens (and they do happen), good movers will fix it. According to the American Moving & Storage Association, if you hire professional movers for a relocation, you can expect to pay at least $1,000. They say the average cost of a local household move is $2,300, and the average cost of a long distance move is $4,300. Your moving costs will depend on many factors like distance traveled, weight of belongings, moving date, labor costs and any other services or materials.

Be sure to check out Homes for Heroes Local Deals to see if we have a moving specialist in your area who is committed to reducing the cost of their services for heroes like you.

If you plan to do the moving work yourself, there is no insurance to cover damages, but you will save the hefty cost of hiring professionals. Sometimes friends, family, and a bribe of pizza are the best moving plan and cost saving option.

Packing Supplies

If your moving plan includes packing yourself, don’t forget that you’ll need to purchase supplies like bubble wrap, boxes, and tape. Some moving companies also allow you to rent plastic, reusable bins that can handle heavy items well. You can also use some things you already have on hand, like using paper towels between plates to stop them from clinking together.

Storage

What if you sell your current house before you buy a new house? Or, what if your move takes longer than planned because your house closing is delayed? You may need to store some of your items in storage units so you know that they are safe and well looked after. Depending on the type of unit you rent, the cost can range from roughly $100 – $200 per month. The cost could depend on whether the unit is climate-controlled as well.

Boarding Pets

Many pet owners choose not to put their beloved family member through the stress and anxiety of moving, especially if the pet is older, so they may end up boarding their animal overnight. Depending on where you take your pet, boarding can be expensive. Another option is to leave them with a friend or family member who is good with your pet.

Hotel Stay

Maybe you do not plan to have the time or energy to unpack and set up beds, nor do you want to sleep on the floor, so staying in a hotel is a great option. There’s a cost, but a good night sleep to prep for all the unpacking may outweigh the cost.

Utilities

These are unavoidable costs. You will need to set up, cancel, or transfer certain services for your new home. Most homes will need electric, gas, garbage and recycling, water and sewage, cable, internet, phone and possibly security services. Many factors play into the cost of cancelling and setting up these services.

If you are moving within the same city or coverage zone, you most likely will not have to pay fees if you continue using the same utility companies. However, it is best to call ahead and find out before you move.

Replacement Costs

Replacement costs may include items such as the following:

- Drivers license – A new address needs a new license

- Appliances – Maybe your coffee maker broke during the move, or the previous owners took their washer and dryer with them

- Re-stock fridge and freezer – There are only so many perishables you can move and keep at a safe temperature

- Re-stock cupboards – Replace canned and dry goods that didn’t make the trip

- Cleaning supplies – Moving means lots of cleaning

- Gym contract – You may need to find a new one

Deposits

If you are currently renting, you probably paid a deposit upfront before moving into your unit. If you want that deposit back when you move out, you will need to clean and fix up your unit so it looks like it did when you moved in. Make sure your landlord has your new address so they can send your deposit after they have done their walkthrough.

The Unexpected

The one thing you can count on when moving is that something you can’t count on will happen. You lost your bath towels, or the dresser was scratched in the moving van. Or maybe the seller of the home took all the curtain rods, and you have no privacy anymore. Whatever the issue, just know you’ll probably need some cash on hand in the first days and weeks after moving for unexpected things.

Save on These Costs Using Homes for Heroes Specialists

When buying a home, the little costs can add up. Whether it’s paying for movers, utility deposits, or transfer fees, moving is expensive. That doesn’t include any renovation costs or other improvements you want to make before settling into your new home.

Homes for Heroes can help you save on these costs. Our heroes save an average of $2,400 when they work with our specialists. When you buy a home with Homes for Heroes, you will receive a Hero Rewards savings check after closing that you can use to purchase what you need for your new home.

Simply sign up to speak with our local specialist. There’s no obligation. They are honored to work with heroes like you, and save you significant money in the process.

Making room in your budget for the cost of buying a house will help avoid unpleasant surprises. It will also make the experience less stressful and more enjoyable as you begin life in your new home.

Estimate Your Savings

Learn how much you could save on your home purchase. Adjust the slider to see potential savings when you buy with a Homes for Heroes real estate and mortgage specialist. This is an estimate. Your actual savings may vary.