Welcome to the U.S. Housing Market Trends September 2025 monthly update from Homes for Heroes. This report focuses on the residential real estate housing market. We listen to the experts and boil down what they have to say to assist you, our heroes, with useful information to help you understand current housing market conditions and how they apply to your goal of buying a home, selling your home, or refinancing your mortgage.

Housing Market Trends September 2025 Key Takeaways

The housing market is ever-evolving. Economic factors, government policies, interest rates, and even socio-cultural shifts can play a role in how the market behaves. That said, here are some current housing market trends to help keep you informed as you determine what’s best for you.

- Inventory Varies Dramatically by Region – While the nation is still 13% below pre-pandemic inventory levels, 12 states now exceed normal inventory; creating vastly different buying and selling experiences depending on your location.

- Mortgage Rates Trending Down – Rates have declined since the end of July and many believe this may be in anticipation of the Federal Reserve lowering rates 0.25% when they meet on September 17, 2025.

- Home Prices Show Regional Cooling – Following 55% national price increases over five years, half of the top 50 metros are now seeing a year-over-year price decrease of 3-4%. This decline is a hot market adjustment, not a crash.

- Save with Homes for Heroes – Homes for Heroes gives back to community heroes (firefighters, EMS, law enforcement, active-duty military and veterans, healthcare professionals, and teachers) with an average savings of $3,000 after buying, selling, or refinancing a home with their local specialists. Sign up today and a Homes for Heroes local specialist will contact you to answer your questions.

Housing Market Trends September 2025 Details

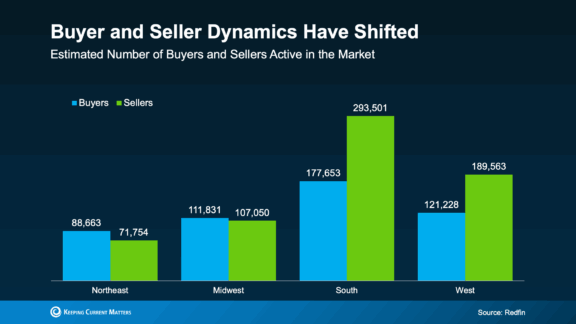

More Buyers or Sellers? Your Location Matters

The housing market isn’t the same everywhere. In fact, we’re seeing a regional difference in the estimated active buyers and sellers in the market across our country.

What does this mean for you:

If you live in the Northeast or Midwest, there’s a good chance you’re experiencing:

- Homes selling quickly (sometimes within days)

- More buyers than available homes

- Prices holding steady or still climbing

- Limited inventory making it feel competitive

If you’re in the South or West, you may experience a different set of circumstances like:

- Homes sitting on the market longer

- More choices available to buyers

- Some areas seeing slight price decreases

- A more relaxed buying environment

Action Steps by Your Situation:

First-Time Buyers:

- In the Northeast or Midwest – Get pre-approved first so you are ready to move quickly when you find the house you want and can make an offer quickly.

- In the South or West – Take your time if it allows. Work with your agent to negotiate on price and don’t be afraid to ask for seller concessions.

Current Homeowners Looking to Buy:

- In the Northeast or Midwest – Consider timing your sale and purchase carefully – you’ll likely sell quickly but face competition buying.

- In the South or West – You might have more negotiating power as a buyer, but your current home might take longer to sell.

Homeowners Looking to Sell:

- In the Northeast or Midwest – Leverage your real estate agent’s market knowledge to price competitively and you’ll likely see quick results.

- In the South or West – Also leverage your real estate agent’s market knowledge and price your home realistically. Be prepared for longer market times, and strongly consider making small improvements to your home so it stands out.

Sign up today to speak with our local Homes for Heroes real estate specialist. They have the local market insight that will enable you to achieve your home buying or selling goals. After you sign up on our site, they will contact you to answer any questions you may have about your community trends.

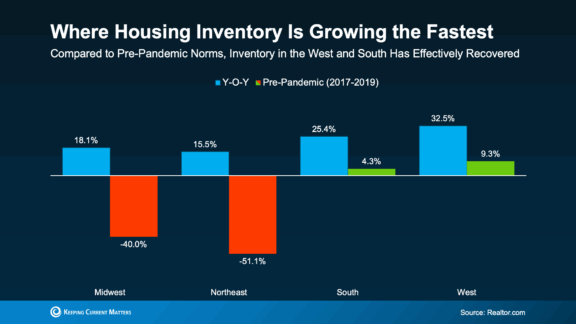

Home Inventory – Numbers That Matter to Your Wallet

Home inventory levels can directly affect whether you’ll find a home that fits your needs at a price you are willing to pay.

Nationally, we still have about 13% fewer homes for sale compared to normal pre-pandemic years (2017-2019).

Regional Housing Inventory Growth

- The South and West continue to see the most inventory growth year-over-year.

- The Northeast and Midwest inventory levels are still tight by comparison, but they continue to move toward more buyer-friendly conditions.

- This explains why your experience varies so much based on where you live.

What This Means in Simple Terms:

- Less inventory = potentially higher home prices

- More inventory = downward pressure on prices

- Currently, 12 states and the District of Columbia are above pre-pandemic inventory levels (Fl, TN, NE, TX, OK, CO, ID, UT, AZ, OR, WA, HI).

How This Affects Your Plans

First-Time Buyers

- In low-inventory areas, start looking early, get pre-approved, and consider expanding your search radius.

- In higher-inventory areas, you have more negotiating power, so work with your real estate agent to use it effectively.

Homeowners Looking to Buy

The inventory in your current area affects your selling timeline, while inventory in your target buying area affects your buying strategy. Be sure to plan accordingly; especially if you’re moving from one U.S. state to another.

Homeowners Looking to Sell

- In low-inventory markets, you’re in the driver’s seat.

- In higher-inventory markets, focus on making your home the star versus the competition.

Mortgage Rates – Recently Trending Down

We know the mortgage rates are probably not where you want them to be, but here’s what you need to know.

Current Situation (September 2025):

- Interest rates for a 30-year fixed rate conforming conventional mortgage have been stable between 6.5% and 7% for most of 2025.

- Recently the 30-year fixed rate conforming conventional mortgage has been trending down since the end of July, and according to our Mortgage Rate Calculator, it was at a national average of 6.322% on September 7, 2025.

- And, mortgage applications are up compared to last year, meaning people ARE buying.

The gradual drop in mortgage rates over the past 4-5 weeks is likely due to the Federal Reserve potentially dropping rates on September 17, 2025. Many experts are anticipating the Fed to drop rates 0.25% due to the recent jobs report, inflation and other economic factors.

Real Dollars and Cents – Here’s something to consider on a $400,000 loan, every quarter-point drop in your mortgage rate (-0.25%) saves you about $66 per month. That’s nearly $800 per year back in your pocket.

Smart Moves Based on Your Situation

- First-Time Buyers – Don’t try to time the market. If you find the right home and can afford the payment, today’s mortgage rate might look pretty good in a few years. Remember, you can always refinance later if rates drop significantly, but you may not get another shot at the house you want.

- Current Homeowners Looking to Buy – If your current mortgage rate is much lower than today’s rates, factor that into your decision. Sometimes it makes sense to wait, sometimes it doesn’t. Sign up today to speak with our local mortgage specialist to have a real conversation and determine what that looks like for your specific numbers.

- Homeowners Looking to Sell – Higher rates mean fewer buyers can afford your home, but it also means less competition from other sellers who are hesitant to give up their low rates.

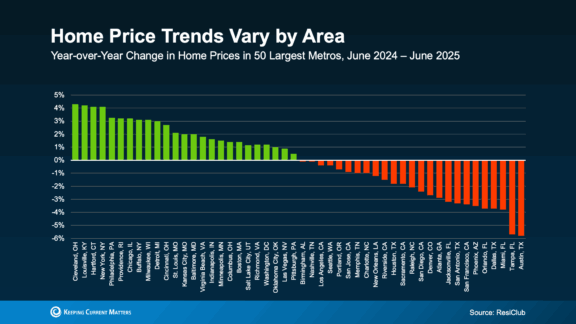

Home Pricing and Affordability – The Bottom Line

The average home price in America has gone up 55% over the last five years. That’s huge.

Some of the hottest markets are starting to see small price drops. Not major drops to cause concern with current homeowners, but low single digit drops (3-4%), giving homebuyers in those markets more affordable housing options.

Important Reality Check – 3-4% price drop after 55% growth over five years is NOT a crash. It’s a slight cooling off in markets that were really hot.

The Affordability Equation – Affordability comes down to three things:

- Home price

- Mortgage rate

- Your income

On average people are earning more money, rates are expected to come down slowly, and prices aren’t rising as rapidly. This combination should gradually improve home affordability.

What This Means for Your Budget:

- First-Time Buyers – Focus on what you can control – your down payment, credit score, and debt-to-income ratio. Don’t wait for the “perfect” market conditions that might never come.

- Current Homeowners Looking to Buy – Your home’s equity gain over recent years might help offset higher borrowing costs.

- Homeowners Looking to Sell – Price your home based on current market conditions in your specific area based on your real estate agent’s local market expertise, not what you think it “should be” worth.

Other Market Trends That Matter Right Now

- The Education Advantage – Most people making housing decisions haven’t been educated about current market conditions. Be sure to find a real estate agent who will take the time to explain the current trends of the local market where you want to buy or sell.

- Sign up today – Start the conversation with our local real estate agent specialist who is committed to helping heroes like you with not only home buying and selling, but who will save you money in the process. It’s their job to know your market.

- Regional Migration – If you’re relocating, understand that you’re moving from one market dynamic to potentially a very different one.

Receive an Average of $3,000 from Homes for Heroes

Homes for Heroes assists firefighters, EMS, law enforcement, active military and veterans, healthcare professionals and teachers; with buying, selling and refinancing their home or mortgage. But if you work with our local real estate and mortgage specialists to buy, sell or refinance; they also provide significant savings after you close on a home or mortgage.

We refer to these savings as Hero Rewards, and the average amount received by a hero who closes on a home with our local specialists is $3,000, or $6,000 if you buy and sell!

Simply sign up to speak with a local Homes for Heroes specialist in your area. There’s no obligation. After you sign up, a member of our team will contact you to ask a few questions and help you determine the appropriate next steps for you.

Our local real estate and/or mortgage specialists in your area are ready and willing to assist you through every step of the process, and save you money when it’s all done.

It is how Homes for Heroes and our local specialists thank community heroes like you for your dedication and valuable service.

Estimate Your Savings

Learn how much you could save on your home purchase. Adjust the slider to see potential savings when you buy with a Homes for Heroes real estate and mortgage specialist. This is an estimate. Your actual savings may vary.