Welcome to the U.S. Housing Market Trends October 2025 monthly update from Homes for Heroes. This report focuses on the residential real estate housing market. We listen to the experts and boil down what they have to say to assist you, our heroes, with useful information to help you understand current housing market conditions and how they apply to your goal of buying a home, selling your home, or refinancing your mortgage.

Housing Market Trends October 2025 Key Takeaways

The housing market is ever-evolving. Economic factors, government policies, interest rates, and even socio-cultural shifts can play a role in how the market behaves. That said, here are some current housing market trends to help keep you informed as you determine what’s best for you.

- Mortgage rates have dropped from 7% in May to under 6.5% in September, saving buyers approximately $250/month or more.

- Home price growth has slowed to its lowest level since summer 2023, with list prices remaining flat and bidding wars mostly over.

- Housing inventory has increased significantly, especially in the South and West where supply has returned to pre-pandemic levels, giving buyers more choices and less competition.

- Save with Homes for Heroes – Homes for Heroes gives back to community heroes (firefighters, EMS, law enforcement, active-duty military and veterans, healthcare professionals, and teachers) with an average savings of $3,000 after buying, selling, or refinancing a home with their local specialists. Sign up today and a Homes for Heroes local specialist will contact you to answer your questions.

Mortgage Rate News You Need to Know

Current Rate Environment

You’ve probably heard about the Federal Reserve and interest rates on the news. The Fed controls something called the “federal funds rate”. It’s different from your mortgage rate, but it does influence it.

Leading up to the Federal Reserve’s announcement on September 17th that dropped the federal funds rate by 0.25%, mortgage rates were already declining in anticipation of the decrease.

The Good News: Mortgage rates have already dropped from about 7% back in May, to less than 6.5% through September. That might not sound like much, but in real dollars, the average monthly mortgage payment has dropped by $250 or more since May!

That’s a big deal. That’s at least $250 more in your budget every single month. Over a year, that’s $3,000. When you’re working in a service profession, that amount of money can help tremendously.

As of September 30, according to OptimalBlue, mortgage rates reflected a 6.315% interest rate for a 30-year fixed-rate conforming conventional loan, and 5.498% for a 15-year conforming conventional loan. Big difference from mortgage rates in May.

Here Homes for Heroes provides interest rate estimates through yesterday and a “Rate Trends” tab for historical reference.

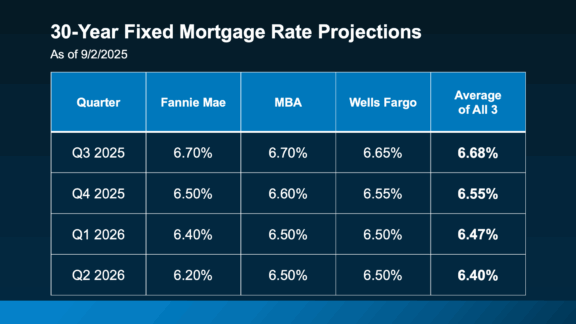

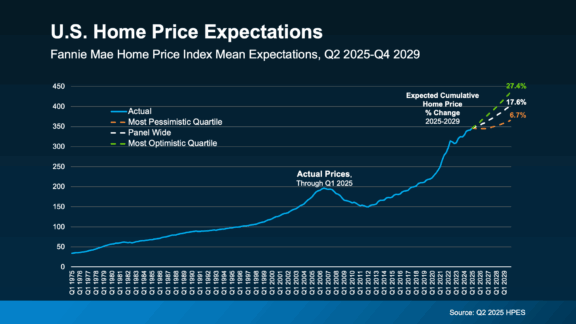

Financial experts like Fannie Mae, Wells Fargo, and the Mortgage Bankers Association are predicting rates could settle around 6.4% by the middle of 2026. There’s always a chance they could settle lower, but let’s be conservative with expectations, and consider taking advantage of the current trend.

What This Means for VA and FHA Buyers

If you’re a veteran, active-duty military, or other service professionals who qualify for an FHA loan (and many teachers, healthcare workers, and first responders do), you’re in an especially good position right now.

VA loans require no down payment. With rates dropping and home prices moderating, you can get into a home with less money upfront than you’ve needed in years.

FHA loans, which only require 3.5% down, are also becoming more affordable as rates ease.

If you are considering a VA loan or FHA loan, these government-backed programs are running slightly better rates (dependent upon your financial circumstances), and the terms may help offset the impact of borrowing costs.

OptimalBlue Notes VA and FHA 30-Year Fixed Rates for September 30, 2025:

- VA Loan: 5.819%

- FHA Loan: 6.084%

Another way for you to offset costs is to sign up today and speak with local Homes for Heroes real estate and mortgage specialists. They will contact you to answer any questions you may have, and how you can save an average of $3,000 when you buy and sell a home with Homes for Heroes.

Home Prices are Doing Something They Have Not Done Since 2023

Here is some clarification on things you may hear on the news regarding phrases like; “home prices are moderating” or “list prices have flattened.”

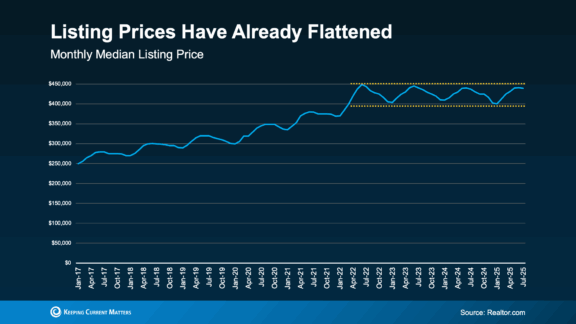

For the past few years, home prices just kept climbing. Sellers would list a home, and within days they’d have multiple offers over asking price.

You may have experienced this frustration yourself if you have been shopping for a home recently; where you see a home you could barely afford, put an offer on it, and lose it in a bidding war.

That’s changing.

The amount sellers are asking for their homes, called “list prices”, have been basically flat since early 2023. In many areas, they’re staying steady or even coming down slightly. The rate of home price growth has slowed to its lowest point since the summer of 2023.

U.S. Regional Opportunities

If you’re in the South or West regions, you’re seeing some of the best conditions:

- Inventory (the number of homes available) has recovered to pre-pandemic levels

- More homes for sale means more choices in your price range

- Home price growth has slowed significantly to around 1.1% to 1.3% in areas like the West South Central and South Atlantic regions

- What does this mean? Sellers are more willing to negotiate

If you’re in the Midwest or Northeast, your market looks a bit different:

- Prices are still appreciating (going up), around 3.8% to 6.7% depending on your specific area

- But the pace is slowing down

- The combination of slightly dropping mortgage rates is helping offset the higher prices

What “flattening” and “moderating” really mean for first-time buyers:

- Remember those bidding wars? They’re mostly over.

- Remember feeling like you had zero negotiating power? That’s changing.

- Remember sellers who wouldn’t budge on price or repairs? They’re more flexible now.

The market has cooled off. And for buyers, especially those of you working within tight budgets, this cooldown is your opportunity.

Sign up today to speak with our local real estate specialist to get your questions answered and learn more about the current opportunities in the communities where you want to live.

Inventory Shift: More Homes, More Choices

Existing Home Inventory

According to the National Association of REALTORS (NAR), August 2025 brought 4.6 months of inventory supply (homes available to purchase).

Even though existing home inventory declined slightly in August to 1.53 million units nationwide versus the previous month of July 2025, this still reflects a substantial 11.7% increase compared to year-over-year, August 2024.

Here’s another piece of good news: there are simply more homes available for sale than there were a year ago, especially in the South and West U.S. regions.

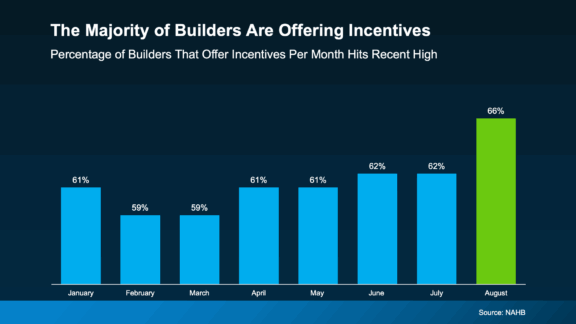

Builders are competing hard for your business right now.

The data shows that 66% of home builders are offering incentives. That’s the highest it’s been in recent memory. And 37% of builders have actually cut their prices.

What Builder Incentives Mean for Your Budget

When builders offer incentives, they might include:

- Rate buydowns: They pay money upfront to lower your mortgage rate by 0.5% to 1% for the first few years

- Closing cost coverage: They pay some or all of your closing costs (which can be $5,000 to $15,000)

- Upgrades included: Things like better appliances, flooring, or landscaping at no extra charge

- Price reductions: Straight discounts off the list price

Don’t be shy about asking your real estate agent about these opportunities. Builders have these programs because they want to sell homes. Your job is to take advantage of every one that benefits you.

Important Historical Perspective

Here’s something that might give you another perspective and offer some hope.

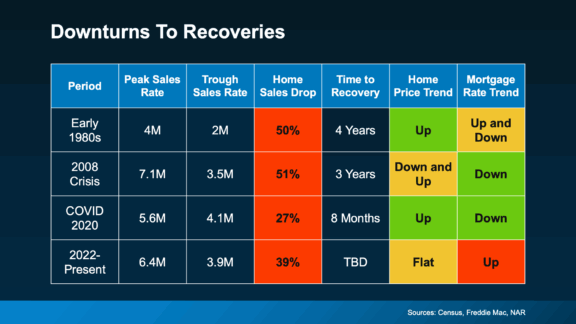

Over the past 50 years, the housing market has gone through several major slowdowns:

- Early 1980s recession (when rates went above 18%!)

- The 2008 financial crisis

- The COVID pandemic in 2020

- And now, the current slowdown from 2022 to present

What happened? The market recovered every single time.

Home sales dropped during each downturn, and then they came back. Home prices either stayed steady or went up. The people who acted while others waited benefited the most when things turned around.

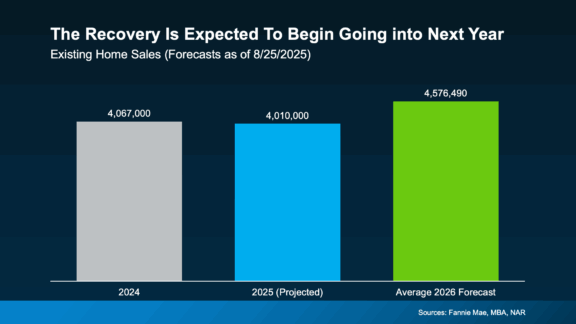

Right now, experts are predicting that recovery will begin going into 2026. They expect home sales to increase from about 4 million nationwide this year to 4.5 million next year.

That typically translates to more competition, likely higher home prices, and potentially less negotiating power for buyers.

Downturns create opportunities. Recoveries reward those who acted. We’re in the opportunity phase right now.

Your Action Step: Don’t wait for the perfect moment or the absolute bottom of the market. You’ll never know it was the bottom until it’s already passed. If you’re financially ready, the numbers work, and you’ve found a home that meets your family’s needs, seriously consider moving forward now rather than in 6-12 months when you might be competing against more buyers again.

Receive an Average of $3,000 from Homes for Heroes

Homes for Heroes assists firefighters, EMS, law enforcement, active military and veterans, healthcare workers and teachers; with buying, selling and refinancing their home or mortgage. But if you work with our local real estate and mortgage specialists to buy, sell or refinance; they also provide significant savings after you close on a home or mortgage.

We refer to these savings as Hero Rewards, and the average amount received by a hero who closes on a home with our local specialists is $3,000, or $6,000 if you buy and sell!

Simply sign up to speak with a local Homes for Heroes specialist in your area. There’s no obligation. After you sign up, a member of our team will contact you to ask a few questions and help you determine the appropriate next steps for you.

Our local real estate and/or mortgage specialists in your area are ready and willing to assist you through every step of the process, and save you money when it’s all done.

It is how Homes for Heroes and our local specialists thank community heroes like you for your dedication and valuable service.

Estimate Your Savings

Learn how much you could save on your home purchase. Adjust the slider to see potential savings when you buy with a Homes for Heroes real estate and mortgage specialist. This is an estimate. Your actual savings may vary.