Welcome to the U.S. Housing Market Trends June 2025 monthly update from Homes for Heroes. This report focuses on the residential real estate housing market. We listen to the experts and boil down what they have to say to assist you, our heroes, with useful information to help you understand current housing market conditions and how they apply to your goal of buying a home, selling your home, or refinancing your mortgage.

Housing Market Trends June Key Takeaways

The housing market is ever-evolving. Economic factors, government policies, interest rates, and even socio-cultural shifts can play a role in how the market behaves. That said, here are some current housing market trends to help keep you informed as you determine what’s best for you.

- Mortgage rates may ease slightly throughout 2025, improving affordability.

- Housing inventory is rising, but still below normal levels.

- Home prices are growing moderately, not crashing, offering a more balanced market.

- Waiting to buy could cost more later; now is a smart time to act.

- Sellers should price competitively and expect standard negotiations.

- Save with Homes for Heroes – Homes for Heroes gives back to community heroes (firefighters, EMS, law enforcement, active-duty military and veterans, healthcare professionals, and teachers) with an average savings of $3,000 after buying, selling, or refinancing a home with their local specialists. Sign up today to begin and a Homes for Heroes local specialist will contact you to answer your questions.

Mortgage Rate Trends – Signs of Relief on the Horizon

In May mortgage rates have slightly increased on average throughout the month. According to Optimal Blue Mortgage Market Index data (as of May 19, 2025), the national average 30-year fixed mortgage rate sits at 6.859%.

What’s causing this recent increase in rates? One reason could be that the Federal Reserve has maintained its wait-and-see approach and kept their benchmark interest rate unchanged following their May meeting on Wednesday, May 7th. The meeting focused on two key economic indicators:

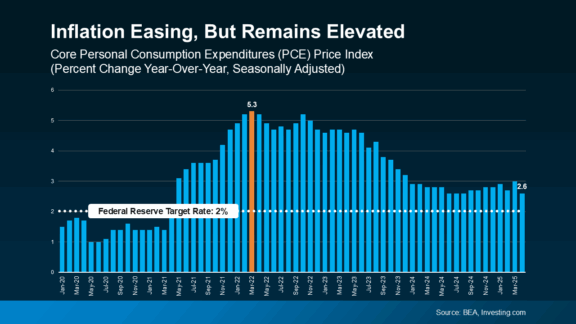

- Inflation – While still above the Fed’s 2% target, recent data shows inflation easing slightly in April, a positive sign for future rate cuts. However, officials are further studying the economic impact of the new tariffs.

- Employment – Unemployment remains steady at 4.2%, indicating economic stability.

According to CNN Business coverage of the post-meeting press conference, Fed Chair Jerome Powell said the U.S. economy is currently healthy, but the tariffs will “materially affect its trajectory.”

This is yet to be seen, but people are wondering what will happen to the average household budget allocation as the new tariffs begin to impact consumer goods and retail pricing.

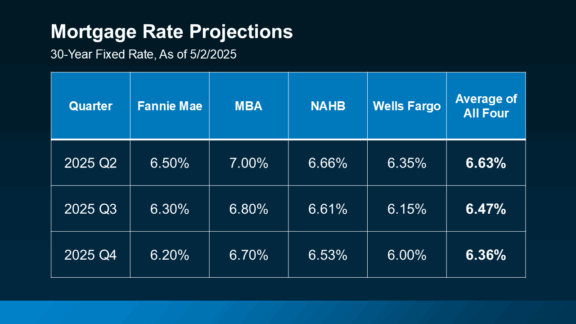

What to expect: Based on projections from leading housing authorities including Fannie Mae, MBA, NAHB, and Wells Fargo, we can anticipate gradual improvements in mortgage rates throughout 2025:

- Q2 2025: Average projection of 6.63%

- Q3 2025: Average projection of 6.47%

- Q4 2025: Average projection of 6.36%

Looking further ahead into 2026, experts forecast rates potentially settling in the low 6% range. While these rates remain above the historic lows of 2020-2022, even small decreases can significantly impact affordability for our heroes with strict budgets.

Housing Inventory – More Options, But Still Below Normal

Good news for buyers: housing inventory is increasing. This provides more choices than we’ve seen in recent years. Current data shows inventory levels are approximately 30% higher than this time last year. This improvement means less competition and potentially more negotiating power for our heroes looking to purchase.

However, it is important to note that inventory remains about 16% below pre-pandemic levels (2017-2019). This means we’re still in what economists consider a “seller’s market,” though a more balanced one than in recent years.

For our heroes, who often need to relocate for work or growing families, this gradual inventory increase provides more opportunities to find suitable housing that meets your needs without the extreme competition of previous years.

Home Prices – Moderate Growth, Not a Crash

Despite concerns about a housing market crash (with surveys showing 70% of Americans worried about this possibility), housing economists remain confident that a housing crash is highly unlikely in 2025 due to the following reasons:

- Basic economics – There is not enough housing inventory supply to cause prices to crash, according to economists like Lawrence Yun with the National Association of REALTORS.

- Slowing but positive growth – Home price appreciation has moderated from the unsustainable pace of previous years. The latest data from FHFA shows home prices growing year-over-year at 3.9% as of February 2025, down from approximately 7% a year ago.

- Regional variation – Some markets may see stronger growth while others experience flat prices or even small declines, but economists don’t expect widespread significant home price depreciation.

This moderation in home price growth combined with wage increases could gradually improve affordability, even as prices continue to rise at a more sustainable pace.

Recommendations for Hero Buyers and Sellers

You have a demanding schedule and important community responsibilities, so staying informed about the housing market is essential when planning your next move. These tips are offered to help you navigate today’s housing landscape based on the trends we’ve covered.

Hero Homebuyer Tips

- Don’t wait for a crash that likely won’t come. With nearly 1 in 4 potential homebuyers (22%) delaying their plans to purchase a home due to market concerns, you may face less competition by moving forward now.

- Consider the cost of waiting. Even with projected modest rate decreases, continued price appreciation means the overall cost of homeownership will likely be higher next year than today.

- Leverage your service-specific benefits. This is a perfect time to use programs like Homes for Heroes. And, to utilize programs like VA loans for military members and veterans or specialized lending programs for first responders, healthcare workers, and teachers that allow for lower down payments.

- Be prepared to act quickly but not desperately. While inventory is improving, desirable homes in good locations still move relatively quickly. Have your financing pre-approved and documents ready.

Hero Home Seller Tips

- Price strategically from the start. With more inventory and price-sensitive buyers, homes priced too aggressively may sit longer on the market. Work with an agent familiar with service professionals’ needs to set the right price.

- Consider timing. With mortgage rates projected to decrease gradually through 2025, selling in the latter half of the year might mean more buyers can afford your home.

- Prepare for more traditional negotiations. The days of multiple offers significantly over asking price have largely passed in most markets. Be prepared for more typical negotiation processes and perhaps providing some seller concessions.

- Leverage your home’s appeal to fellow local hero service professionals. Features like short commutes to hospitals, schools, or stations can be significant selling points for buyers in similar professions.

Receive an Average of $3,000 from Homes for Heroes

Homes for Heroes assists firefighters, EMS, law enforcement, active military and veterans, healthcare professionals and teachers; with buying, selling and refinancing their home or mortgage. But if you work with our local real estate and mortgage specialists to buy, sell or refinance; they also provide significant savings after you close on a home or mortgage.

We refer to these savings as Hero Rewards, and the average amount received by a hero who closes on a home with our local specialists is $3,000, or $6,000 if you buy and sell!

Simply sign up to speak with a local Homes for Heroes specialist in your area. There’s no obligation. After you sign up, a member of our team will contact you to ask a few questions and help you determine the appropriate next steps for you.

Our local real estate and/or mortgage specialists in your area are ready and willing to assist you through every step of the process, and save you money when it’s all done.

It is how Homes for Heroes and our local specialists thank community heroes like you for your dedication and valuable service.

Estimate Your Savings

Learn how much you could save on your home purchase. Adjust the slider to see potential savings when you buy with a Homes for Heroes real estate and mortgage specialist. This is an estimate. Your actual savings may vary.