Welcome to the U.S. Housing Market Trends August 2025 monthly update from Homes for Heroes. This report focuses on the residential real estate housing market. We listen to the experts and boil down what they have to say to assist you, our heroes, with useful information to help you understand current housing market conditions and how they apply to your goal of buying a home, selling your home, or refinancing your mortgage.

Housing Market Trends August 2025 Key Takeaways

The housing market is ever-evolving. Economic factors, government policies, interest rates, and even socio-cultural shifts can play a role in how the market behaves. That said, here are some current housing market trends to help keep you informed as you determine what’s best for you.

- Mortgage rates remain elevated but stable – 30-year fixed rates are hovering around 6.7%, with little relief expected through Q3 2025

- Inventory levels continue rising – More homes are available now than at any point since before the pandemic

- Sellers are making concessions – Price cuts and incentives are becoming the norm, not the exception

- New construction offers significant value – Builders are buying down rates and cutting prices to move inventory

- Save with Homes for Heroes – Homes for Heroes gives back to community heroes (firefighters, EMS, law enforcement, active-duty military and veterans, healthcare professionals, and teachers) with an average savings of $3,000 after buying, selling, or refinancing a home with their local specialists. Sign up today and a Homes for Heroes local specialist will contact you to answer your questions.

The Big Picture – A Market in Transition

After years of extreme seller advantage, the housing market is experiencing what experts call a “buyer-seller rebalance.” This shift creates both challenges and opportunities for our heroes.

Home Inventory – More Options

The inventory story tells two tales – existing homes and new construction – both favoring today’s buyers.

Existing Home Inventory

According to the National Association of REALTORS (NAR), June 2025 brought 4.7 months of inventory supply. This is a significant improvement over the past few years.

Even though existing home inventory declined slightly in June to 1.53 million units nationwide versus the previous month of May 2025, this still reflects a substantial 15.9% increase compared to year-over-year, June 2024.

Typically a balanced market has 5-6 months of supply. At 4.7 months, we’re approaching more normal conditions, giving buyers meaningful choices without the crazy competition of recent years.

New Construction Homes

The new home market presents home buyers with a good opportunity. An abundance of new homes has created a competitive environment among builders, and attractive buyer incentives:

- 57% of new-home communities offered incentives on to-be-built homes in May

- 75% offered incentives on quick move-in (QMI) homes

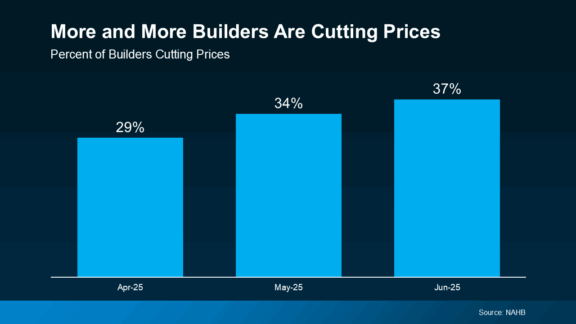

- 37% of builders cut prices in June. According to the National Association of Home Builders (NAHB). This is the highest percentage since NAHB began tracking these monthly numbers in 2022

The Buyer-Seller Dynamic Has Shifted

There are fewer buyers actively searching for a home in the market today due to home affordability issues (higher interest rates and home price increases). Now that inventory levels have risen consistently over the past year, sellers (not just home builders) are feeling the pressure to decrease their asking price.

Generally speaking, this makes it far less competitive for home buyers when they submit an offer to a seller. Last year at this time, homes would have multiple offers from several potential buyers in most markets, and often the buyers would likely offer more than the seller’s asking price.

That’s no longer the case, making this a better time to enter the market if you’re considering starting to shop around for a new home.

Sign up today to speak with our local Homes for Heroes real estate specialist. They will contact you to answer any questions you may have about your community trends.

Home Prices – Growth Slowing, Some Markets Declining

National Price Trends

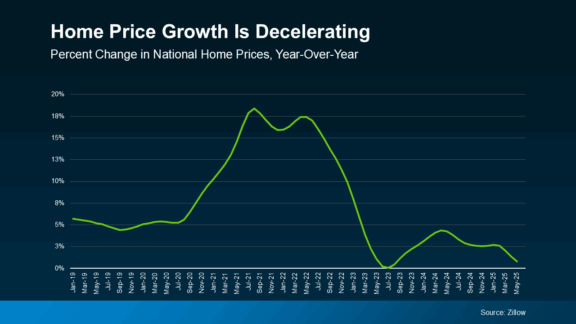

Home price appreciation is decelerating. NAR reported the median existing home price in June 2025 was $435,300, up just 2% from June 2024. This has been the trend, and is a dramatic slowdown from the double-digit increases in 2021-2022.

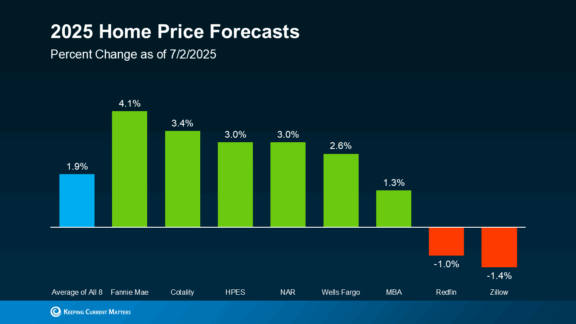

Industry forecasters project even more modest gains ahead. As of July 2025, eight major forecasting organizations predict average home price appreciation of just 1.9% for 2025, with two (Redfin and Zillow) actually forecasting price declines.

Regional Variations Matter

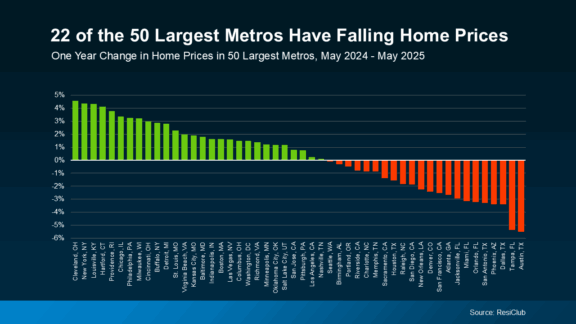

While national trends show slowing growth, local markets vary significantly. Currently, 22 of the 50 largest U.S. metros are experiencing year-over-year price declines, led by Tampa, Florida (-5.4%) and Austin, Texas (-5.2%).

However, many markets still continue to see modest appreciation, particularly in the Northeast and parts of the Midwest where inventory remains tighter.

Mortgage Rates – Likely Steady Through 2025

Current Rate Environment

As of July 28, according to OptimalBlue, mortgage rates reflected a 6.734% interest rate for a 30-year fixed-rate conventional loan, and 5.946% for a 15-year conventional loan. Mortgage interest rates have fluctuated between 6.5% and 6.8% in recent weeks.

Here we offer interest rate estimates through yesterday and a “Rate Trends” tab for historical reference.

For heroes considering a VA loan or FHA loan, these government-backed programs are running slightly better rates (dependent upon your financial circumstances), and the terms may help offset the impact of borrowing costs.

Another way for heroes to offset costs is to sign up today and speak with local Homes for Heroes real estate and mortgage specialists. They will contact you to answer any questions you may have, and how you can save an average of $3,000 when you buy or sell a home.

Rate Outlook – Limited Relief Expected

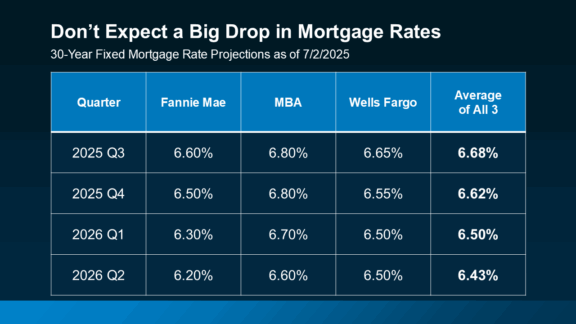

Forecasters estimate mortgage rates will remain in the 6.4-6.7% range through Q3 2025, with minimal relief expected over the next 12 months:

- Q3 2025: 6.68% average

- Q4 2025: 6.62% average

- Q1 2026: 6.50% average

- Q2 2026: 6.43% average

Builder New Home Rate Buy-Down Trend

While rates remain elevated for existing homes, new construction offers a compelling alternative. Builders are using incentives to buy down rates, with new home buyers securing rates approximately 0.5 percentage points below existing home rates.

Your Action Plan by Situation

If You’re a First-Time Buyer

The Good News:

This is the best buying environment for first-time purchasers in years. Higher inventory, seller concessions, and reduced competition create opportunities that didn’t exist since before the pandemic.

Your Strategy:

- Explore new construction – With builders offering rate buy-downs and price cuts, new homes may be more affordable than existing ones

- Maximize your government benefits – VA and FHA loans offer competitive rates and low down payment options

- Don’t rush – Unlike recent years, you have time to be selective and negotiate

- Get pre-approved early – While competition is reduced, being ready to move quickly on the right home remains important. Sign up today to speak with a Homes for Heroes mortgage specialist who can get your started, and save you money at closing.

Reality Check:

Even with improvements, affordability remains challenging. Maybe consider markets outside major metros where your dollar stretches further.

If You Want to Buy Your Next Home

The Good News:

Move-up buyers face less competition and have more negotiating power than they’ve had in years. If you’ve built equity in your current home, you have advantages in today’s market.

Your Strategy:

- Timing – Consider whether you need to sell first, or if you have the financial ability to buy a home before selling

- Leverage your equity – Current homeowners have significant equity advantages over first-time buyers

- Negotiate – In today’s market, asking for seller concessions on repairs, closing costs, or price is reasonable

- Consider new construction – Builders’ rate buy-downs and price cuts may make new homes cost-competitive with existing ones

Watch Out For:

If you’re moving from a lower-cost area to a higher-cost area, be sure to carefully evaluate how the rate difference on a larger mortgage will impact your monthly payments. Here’s our mortgage calculator to give you an estimate of your new monthly mortgage payment.

If You’re Ready to Sell

The Reality:

In many markets, selling a home today will require different strategies than recent years. The days of multiple offers above asking price are almost over, but qualified buyers are actively looking.

Your Strategy:

- Price strategically from day one – Overpricing in today’s market leads to extended time on market and eventual price reductions. Our local Homes for Heroes real estate specialist can assist you with a solid pricing strategy, and save you significant money. Sign up today and our local specialist will contact you and answer any questions.

- Prepare for negotiations – Buyers have more power to negotiate on price, repairs, and terms

- Consider timing – Inventory typically peaks in summer, so selling before the seasonal slowdown may be advantageous

- Highlight unique value – Know what makes your home special and unique when compared to other homes in your community that buyers would find valuable

Market Reality:

While you may not achieve the premium prices of 2021-2022, current prices still represent significant appreciation from pre-pandemic levels for most homeowners.

Receive an Average of $3,000 from Homes for Heroes

Homes for Heroes assists firefighters, EMS, law enforcement, active military and veterans, healthcare professionals and teachers; with buying, selling and refinancing their home or mortgage. But if you work with our local real estate and mortgage specialists to buy, sell or refinance; they also provide significant savings after you close on a home or mortgage.

We refer to these savings as Hero Rewards, and the average amount received by a hero who closes on a home with our local specialists is $3,000, or $6,000 if you buy and sell!

Simply sign up to speak with a local Homes for Heroes specialist in your area. There’s no obligation. After you sign up, a member of our team will contact you to ask a few questions and help you determine the appropriate next steps for you.

Our local real estate and/or mortgage specialists in your area are ready and willing to assist you through every step of the process, and save you money when it’s all done.

It is how Homes for Heroes and our local specialists thank community heroes like you for your dedication and valuable service.

Estimate Your Savings

Learn how much you could save on your home purchase. Adjust the slider to see potential savings when you buy with a Homes for Heroes real estate and mortgage specialist. This is an estimate. Your actual savings may vary.